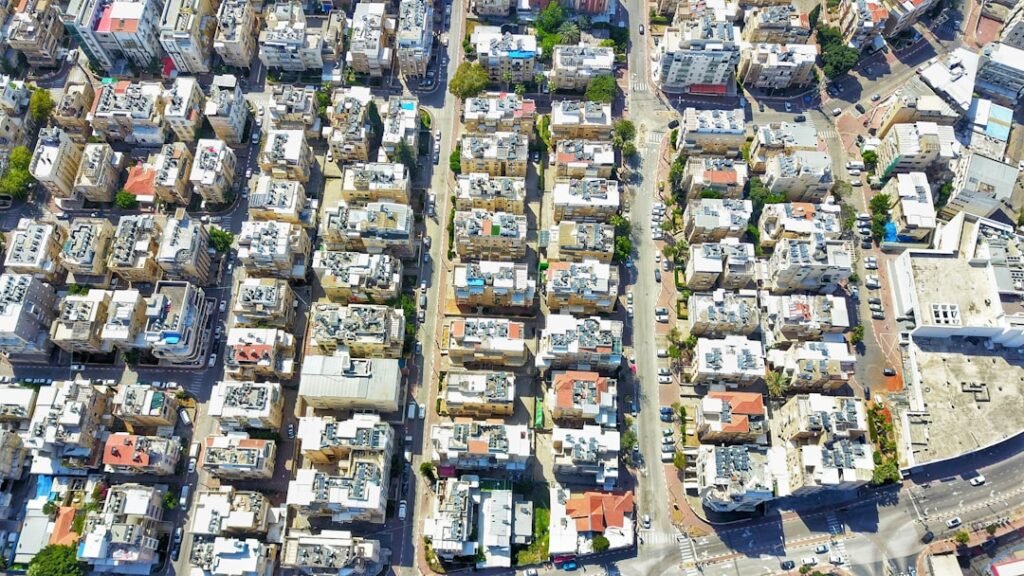

Real estate investments have long been regarded as a cornerstone of wealth-building strategies. This form of investment involves purchasing, owning, managing, renting, or selling real estate for profit. Investors can engage in various types of real estate, including residential properties, commercial buildings, industrial spaces, and land.

The appeal of real estate lies in its potential for appreciation over time, the ability to generate rental income, and the tangible nature of the asset itself.

Moreover, real estate investments can serve as a hedge against inflation.

As the cost of living rises, so too can rental prices and property values, allowing investors to maintain their purchasing power. Additionally, real estate can provide tax advantages, such as deductions for mortgage interest and depreciation. However, successful real estate investing requires a deep understanding of market dynamics, property management, and financial analysis.

Investors must be prepared to navigate the complexities of the market and make informed decisions to maximize their returns.

Key Takeaways

- Real estate investments involve direct property ownership, while REITs allow investment in real estate portfolios through the stock market.

- Investing in real estate offers benefits like property control and potential appreciation but requires significant capital and management effort.

- REITs provide liquidity, diversification, and passive income but may be subject to market volatility and less control.

- Key factors in choosing between real estate and REITs include investment goals, risk tolerance, capital availability, and desired involvement level.

- Making the best investment decision requires weighing the pros and cons of each option in relation to personal financial objectives.

Exploring REITs: Real Estate Investment Trusts

Real Estate Investment Trusts (REITs) have emerged as a popular alternative for those looking to invest in real estate without the burdens of direct property ownership. A REIT is a company that owns, operates, or finances income-producing real estate across various sectors. By pooling funds from multiple investors, REITs allow individuals to invest in large-scale real estate projects that would otherwise be inaccessible.

This structure not only democratizes real estate investment but also provides liquidity that traditional real estate investments lack. Investors can choose from different types of REITs, including equity REITs, which own and manage properties; mortgage REITs, which provide financing for income-producing real estate; and hybrid REITs that combine both strategies. The appeal of REITs lies in their ability to offer regular dividend payments, as they are required by law to distribute at least 90% of their taxable income to shareholders.

This makes them an attractive option for income-seeking investors who prefer a more hands-off approach to real estate investment.

Pros of Investing in Real Estate

Investing in real estate offers numerous advantages that can significantly enhance an investor’s portfolio. One of the most compelling benefits is the potential for substantial appreciation over time. Historically, real estate values have tended to rise, providing investors with the opportunity to sell properties at a profit after holding them for several years.

This long-term growth potential is often seen as a safer bet compared to the volatility of stock markets. Additionally, real estate investments can generate consistent cash flow through rental income. For many investors, this steady stream of income can provide financial stability and help cover mortgage payments or other expenses associated with property ownership.

Furthermore, owning real estate can offer tax benefits that are not available with other investment types. Deductions for mortgage interest and property depreciation can significantly reduce an investor’s taxable income, enhancing overall returns.

Cons of Investing in Real Estate

Despite its many advantages, investing in real estate is not without its challenges and drawbacks. One significant downside is the high barrier to entry associated with purchasing properties. Investors often need substantial capital for down payments and closing costs, which can limit access for many individuals.

Additionally, the ongoing costs of property maintenance, taxes, and insurance can add up quickly, impacting overall profitability. Another concern is the illiquidity of real estate investments. Unlike stocks or bonds that can be easily bought or sold on the market, real estate transactions can take time and effort to complete.

Moreover, the real estate market is subject to fluctuations based on economic conditions, interest rates, and local market dynamics, which can pose risks for investors who are not well-informed or prepared.

Pros of Investing in REITs

| Aspect | Real Estate | REITs |

|---|---|---|

| Liquidity | Low – Properties can take months to sell | High – Shares can be bought/sold on stock exchanges |

| Initial Investment | High – Requires significant capital for purchase | Low – Can invest with small amounts via stock market |

| Management | Self-managed or hired property managers | Professionally managed by REIT companies |

| Income Stability | Rental income can vary; vacancies affect cash flow | Regular dividends, often quarterly |

| Tax Considerations | Depreciation and mortgage interest deductions available | Dividends taxed as ordinary income; no depreciation benefits |

| Control | Full control over property decisions | No direct control; decisions made by management |

| Diversification | Typically concentrated in few properties | Provides exposure to diversified real estate portfolios |

| Leverage | Can use mortgage financing to leverage investment | REITs use leverage internally; investors do not directly leverage |

| Volatility | Less price volatility; value changes slowly | Subject to stock market fluctuations |

| Entry Barriers | High due to cost and complexity | Low; accessible via brokerage accounts |

Investing in REITs presents several advantages that make them an appealing option for many investors. One of the primary benefits is liquidity; shares of publicly traded REITs can be bought and sold on stock exchanges just like any other stock. This ease of transaction allows investors to enter or exit their positions quickly without the lengthy processes associated with traditional real estate transactions.

Furthermore, REITs provide diversification within the real estate sector without requiring significant capital investment. By investing in a single REIT, individuals gain exposure to a portfolio of properties across various locations and sectors, reducing the risk associated with investing in a single property. Additionally, REITs typically offer attractive dividend yields due to their requirement to distribute most of their income to shareholders.

This makes them particularly appealing for income-focused investors seeking regular cash flow.

Cons of Investing in REITs

While REITs offer numerous benefits, they also come with their own set of disadvantages that potential investors should consider. One major drawback is the lack of control over individual investments. When investing in a REIT, shareholders have no say in property management decisions or operational strategies.

This can be frustrating for those who prefer a hands-on approach to their investments. Moreover, REITs are subject to market volatility similar to stocks. Their share prices can fluctuate based on broader market trends and investor sentiment rather than the underlying performance of the properties they own.

This means that even if a REIT’s properties are performing well, its stock price may still decline due to external factors. Additionally, while REITs provide diversification within the real estate sector, they do not offer the same level of diversification across different asset classes as a broader investment portfolio might.

Factors to Consider When Choosing Between Real Estate and REITs

When deciding between direct real estate investments and REITs, several factors come into play that can influence an investor’s choice. One critical consideration is the investor’s financial situation and risk tolerance. Those with substantial capital and a willingness to engage in property management may find direct ownership more appealing due to its potential for higher returns and tax benefits.

Conversely, individuals seeking lower entry costs and less hands-on involvement may prefer the simplicity and liquidity offered by REITs. Another important factor is investment goals. Investors focused on long-term appreciation may lean towards direct real estate ownership, while those seeking immediate income might find REITs more suitable due to their regular dividend payouts.

Additionally, market conditions should be taken into account; during periods of economic uncertainty or declining property values, REITs may provide a safer alternative due to their diversified portfolios and liquidity.

Making the Best Investment Decision

In conclusion, both direct real estate investments and REITs present unique opportunities and challenges for investors looking to diversify their portfolios and build wealth over time. Understanding the nuances of each option is crucial for making informed decisions that align with individual financial goals and risk tolerance levels. While direct real estate ownership offers potential for significant appreciation and tax benefits, it also comes with higher barriers to entry and ongoing management responsibilities.

On the other hand, REITs provide an accessible way to invest in real estate with greater liquidity and diversification but may lack the control that some investors desire. Ultimately, the best investment decision will depend on an individual’s financial situation, investment objectives, and personal preferences. By carefully weighing these factors and conducting thorough research, investors can position themselves for success in either avenue of real estate investment.

When considering the investment options of real estate versus REITs, it’s essential to understand the broader financial landscape. A related article that delves into wealth accumulation strategies is titled “The Difference Between Being Rich and Being Wealthy.” This piece explores the nuances of wealth management and can provide valuable insights for those weighing their investment choices. You can read it [here](https://globalwealthscope.com/the-difference-between-being-rich-and-being-wealthy/).